Changes to State of Georgia’s G-4 Form Could Affect Your Paycheck

The State of Georgia is making changes to its Form G-4 (Employee’s Withholding Allowance Certificate), reducing the number of withholding allowances permitted, based on your reported marital status.

This change went into effect for bi-weekly paychecks on August 23, 2013 and will go into effect for monthly paychecks on August 30, 2013. The amount in your paycheck could be affected if your number of allowances in the first field on the G-4 entitled “Withholding Allowances” exceeds the new maximum (note: this amount could be substantial if you currently have a high number of allowances in this field).

The following chart illustrates the new maximum allowances in the field entitled “Withholding Allowances”:

Marital Status |

Allowable

Number of Allowances |

New maximum number of withholding allowances |

Single |

0 or 1 |

1 |

Married Filing Joint, both spouses working

OR Married Filing Separate |

0 or 1 |

1 |

Married Filing Joint, one spouse working |

0, 1 or 2 |

2 |

Head of Household |

0 or 1 |

1 |

What do you need to do?

No action is required (Emory’s Payroll Office will automatically apply the new maximum withholdings). However, if you want to ensure that your number of allowances remains the same (i.e. no impact to your paycheck), you can do that online in Self-Service. Here are the steps:

- Log in to Self-Service at http://leo.cc.emory.edu

- Click on Self Service

- Click on Georgia G-4 Data (located under Payroll and Compensation)

- Look at your current Withholding Allowances and your Marital Status. Compare what is in Self-Service with the above chart

- If your allowances exceed the new maximum amounts, you will need to change the amount in the Withholding Allowances box to the new maximum, then, put any overage in the Additional Allowances box

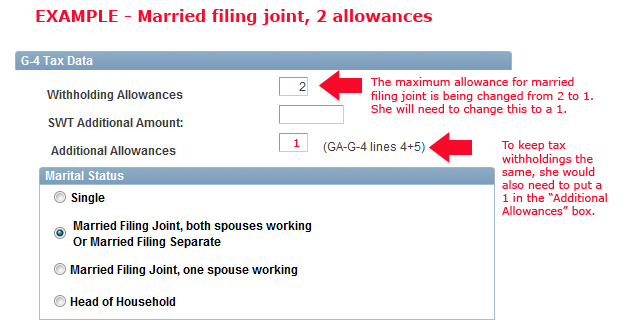

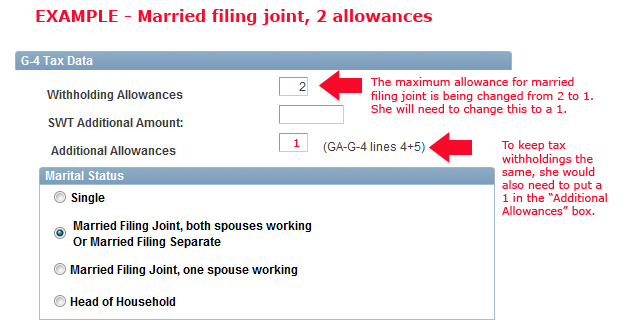

Here is an example of an employee whose Marital Status is Married Filing Joint. She currently has “2” allowances, but the new maximum is now “1.” If she wants her paycheck to remain the same, she will need to change her withholding allowance to “1” and also add a “1” to the “Additional Allowances” box.

|